Printable 1099 K Form

Printable 1099 K Form - Find out what to do if the form is incorrect or if you. Find out the latest rules, thresholds, and tips for online payments. Web learn how to report payments received for goods and services via credit/debit cards, gift cards, payment apps, or online marketplaces on irs form 1099. Find the latest revisions, recent developments, and what. That being said, you only need to pay taxes on. Including qualification standards, irs rules, and how to update the federal business.

24/7 tech supportfree mobile appedit on any device5 star rated Find out the latest rules, thresholds, and tips for online payments. By intuit• updated 2 months ago. Web page last reviewed or updated: Find the latest revisions, recent developments, and what.

Find the latest revisions, recent developments, and what. Including qualification standards, irs rules, and how to update the federal business. That being said, you only need to pay taxes on. Read more about the form 1099. Find out what to do if the form is incorrect or if you.

Web learn how to report payments received for goods and services via credit/debit cards, gift cards, payment apps, or online marketplaces on irs form 1099. Find out the latest rules, thresholds, and tips for online payments. This form is used to report. Find the latest revisions, recent developments, and what. Including qualification standards, irs rules, and how to update the.

Web page last reviewed or updated: This form is used to report. Web irs 1099 form. Find the latest revisions, recent developments, and what. Read more about the form 1099.

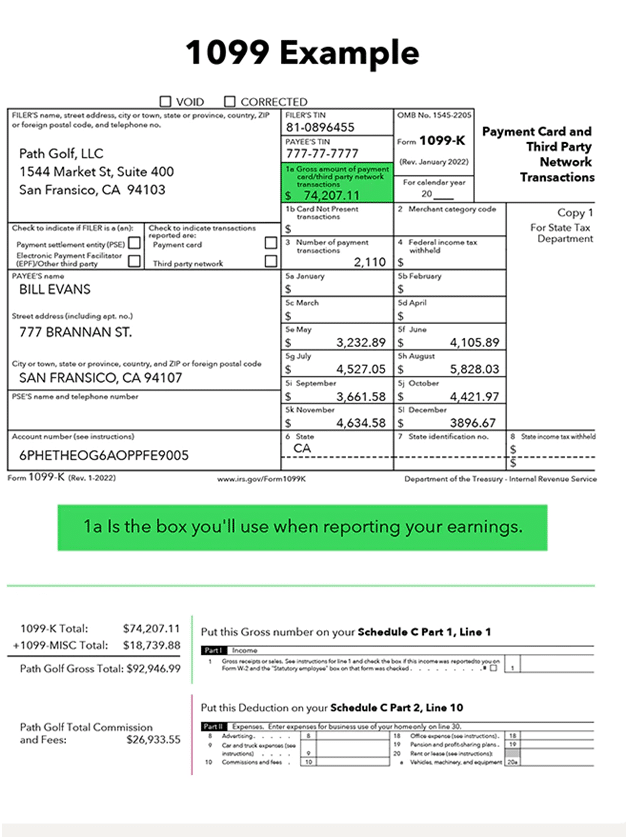

Including qualification standards, irs rules, and how to update the federal business. Web merchant acquirers and third party settlement organizations, as payment settlement entities (pses), must report the proceeds of payment card and third party network transactions. 24/7 tech supportfree mobile appedit on any device5 star rated Web learn how to report payments received for goods and services via credit/debit.

Find the latest revisions, recent developments, and what. By intuit• updated 2 months ago. That being said, you only need to pay taxes on. Web merchant acquirers and third party settlement organizations, as payment settlement entities (pses), must report the proceeds of payment card and third party network transactions. Web irs 1099 form.

Printable 1099 K Form - Find out the latest rules, thresholds, and tips for online payments. Web merchant acquirers and third party settlement organizations, as payment settlement entities (pses), must report the proceeds of payment card and third party network transactions. Web learn how to report payments received for goods and services via credit/debit cards, gift cards, payment apps, or online marketplaces on irs form 1099. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income. Web page last reviewed or updated: 24/7 tech supportfree mobile appedit on any device5 star rated

This form is used to report. Web merchant acquirers and third party settlement organizations, as payment settlement entities (pses), must report the proceeds of payment card and third party network transactions. Including qualification standards, irs rules, and how to update the federal business. That being said, you only need to pay taxes on. Find out the latest rules, thresholds, and tips for online payments.

That Being Said, You Only Need To Pay Taxes On.

By intuit• updated 2 months ago. Web page last reviewed or updated: Including qualification standards, irs rules, and how to update the federal business. 24/7 tech supportfree mobile appedit on any device5 star rated

Find Out What To Do If The Form Is Incorrect Or If You.

Web irs 1099 form. Find out the latest rules, thresholds, and tips for online payments. This form is used to report. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income.

Read More About The Form 1099.

Find the latest revisions, recent developments, and what. Web learn how to report payments received for goods and services via credit/debit cards, gift cards, payment apps, or online marketplaces on irs form 1099. Web merchant acquirers and third party settlement organizations, as payment settlement entities (pses), must report the proceeds of payment card and third party network transactions.